What is a real estate syndication? A real estate syndication, also known as a syndicate is a group of investors – either individuals or organizations – that pool money together to develop or purchase investment properties. A syndication can exist during the life of a deal, or for a specific duration. A syndication is comprised of general and limited partners. General partners – also known as sponsors – guarantee the loan, and oversee the day to day operations of the investment. Limited partners receive returns on their investment.

Why invest with a syndicate? As with any real estate investment, a return cannot be guaranteed. Nevertheless, a syndicate provides the opportunity for significantly greater return in comparison to a stock market. Depending on the structure i.e., the terms of the partnership agreement, investors have the potential to earn a) cash on cash returns, b) preferred returns (if any) and c) profit on the sale of the asset.

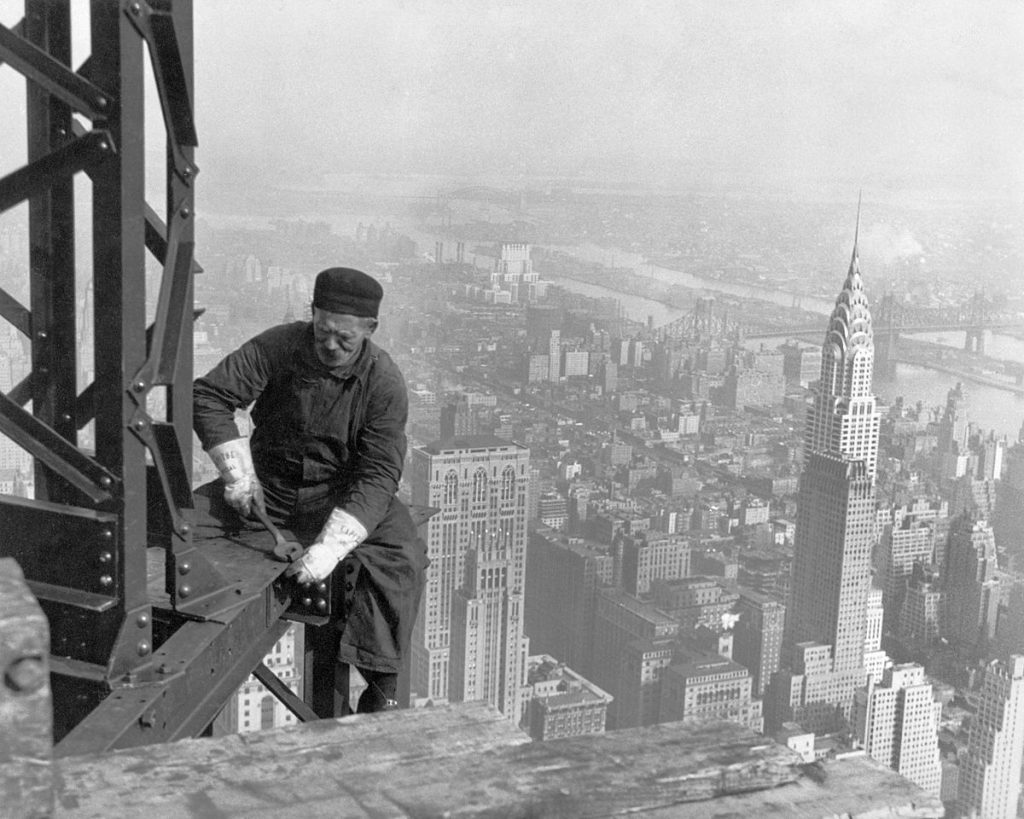

History buff. The concept of syndication was pioneered by Harry Helmsley and Larry Wien in 1931. The first large scale syndication occurred when Helmsley, Wien, and Peter Malkin, raised $33,000,000 from more than 3,000 individuals in order to build the Empire State Building. Prior to 1933, a sponsor – an individual or entity that assembles the deal – was free to raise capital by public advertisement. However, after President Franklin D. Roosevelt’s New Deal, Congress passed the Securities Exchange Act of 1933 (“Act”) tasking the Securities Exchange Commission (“SEC”) with general federal oversight and protection of investors against fraud. After the Act, any sponsor that wanted to publicly advertise an investment had to register it as a security with the SEC. The sponsor was left with two choices: a) register the investment as a security with the SEC, and following approval, advertise publicly; or b) avoid public solicitation and raise money privately. Fast forward to 2012, Congress passed the Jumpstart Our Business Startups (“JOBS“) Act. JOBS permitted general public solicitation under Rule 506(c) without the registration process so long as all purchasers in the offering are accredited investors.

Difference between a private and public syndication. The main difference between these two are the level of investor sophistication and return. A private syndicate requires all investors to be accredited. An investor is accredited if:

- It has a net worth of at least $1,000,000 (million), excluding the value of one’s primary residence; or

- It has an income of at least $200,000 each year for the last two years and is expected to make the same in the present year; or

- Married, the couple has a combined income of at least $300,000 each year for the last two years and are expected to make the same amount in the present year.

A public syndicate does not require investors to be accredited, and any person, whether experienced or not, may purchase shares. Perfect example of a public syndicate is a Real Estate Investment Trust also know as a REIT. REITs are registered on the New York Stock Exchange and can come in the form of an Equity REIT (own the property), Mortgage REIT (own the debt) or a combination of both. As of this writing, there are currently 192 REITs listed on the NYSE.

Difference in the return. In a private syndicate, limited partners receive a) return on their investment i.e., cash on cash return, b) preferred returns depending on the structure and c) a profit on the sale of the asset within a set period of time, usually 3 to 5 years. In a public syndicate, investors receive annual dividends and or profit upon the sale of her stock. There is potential to earn greater returns in a private syndication.

Unlike a public syndicate where investors purchase shares and receive dividends and/or profit after selling their stocks, private investors receive distribution income during the life of the syndicate and return of their capital when the syndicate winds up.

Legal structure of a private syndicate. Typically, syndications are structured as limited liability company (LLC) or a partnership. In an LLC, sponsors are managing members and investors are members. In a partnership, sponsors are general partners and investors are limited partners. Investors have limited liability and only risk losing the investment. Sponsors on the other hand usually guarantee the debt i.e., mortgage on the asset and run the risk of losing everything.

Parties in a syndicate. In every syndicate, there are two main parties, the sponsor(s) and investors. The sponsor is the most important party in the syndicate who is responsible for putting together a business plan, finding investment properties, assembling a team, raising funds, acquiring the property and managing the everyday operations of the acquired property. Investors are weary to invest in a syndicate in which a sponsor does not have a personal stake. Usually, sponsor’s financial equity ranges between 5% – 20% of the total investment equity.

For example, if the syndicate intends to purchase a $20,000,000 property using a mortgage, and the bank requires a typical 20% down payment (or $4,000,000), investors would expect the sponsor(s) to invest between $200,000 to $800,000 as equity.

Investors are usually structured as limited partners (partnership) or members (limited liability company) to minimize their liability. Unlike sponsors, investors typically do not have a say in the day-to-day operations of the asset.